2021 Year-End Turkish Commercial Real Estate Market Outlook Research Report

You can read the most up-to-date and accurate information about the 2021 Year-End Turkish Commercial Real Estate Market Outlook Research Report in our article. In addition to the intense effects of the worldwide Covid-19 epidemic at the beginning of 2021, the developments towards the end of 2021 were promising. With the Covid-19 vaccine, which was put into practice in 2021, relaxations began to occur in the full closure measures. The developments with the Covid-19 outbreak have had a direct impact on the commercial real estate market in Turkey.

World-wide developments affect Turkey’s growth rates. According to TUIK data, the growth rate of 1.8% in the Turkish economy in 2020 was 11% in 2021. Considering the construction sector data; It can be interpreted that the first quarter of 2020 was negative due to many effects. However, the reduction in interest rates as a result of the expansionary monetary policy implemented in the same year contributed positively to the housing sales in 2020.

Although the construction sector in Turkey shrank by 3.5% in total in 2020, the expected positive results from the expansionary monetary policy could be achieved in a short time. Namely; The sector, which experienced a negative course in the first two quarters of 2020, experienced a relief in the third quarter thanks to the reduced interest rates. The short duration of the low interest rate implementation due to the economic conjuncture in the country caused the sector to contract again in the last quarter of 2020.

As a result; In 2020, the share of the construction sector in Gross Domestic Product decreased from 6.5% to 6.2%.

Turkish Commercial Real Estate Market 2020 Housing Sales Retail Market

With the fluctuations experienced in the construction sector periodically in Turkey in 2020, the number of zero house sales was 469,740. In addition, the number of second-hand houses sold in the same year was 1,029,576. Despite the 3.5% shrinkage rate experienced in the construction sector in 2020, house sales were above the average.

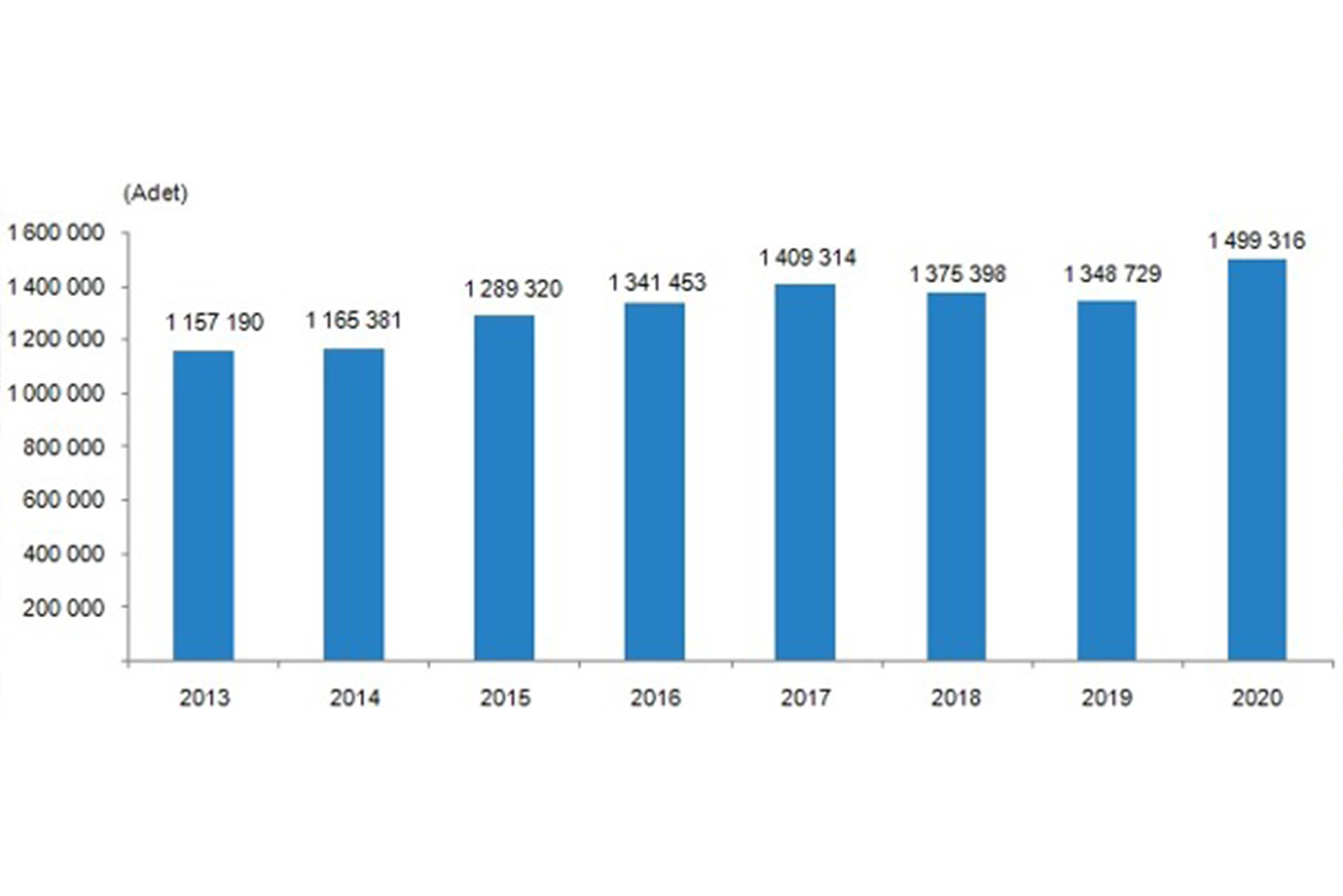

According to TUIK data; In 2020, a total of approximately 1.5 million residences changed hands through sales. Housing sales to foreigners were also at the level of 40 thousand in 2020. The first three provinces with residences built for foreigners in 2020 were as follows:

- Istanbul,

- Antalya,

- Ankara.

The construction cost index data, which is closely related to the commercial real estate market in Turkey, is also extremely important in terms of revealing the status of the sector. According to TUIK data, it is seen that construction costs increased by 25% in 2020. While these construction costs reflect the ratio of building costs, the non-building cost was 24.79% in 2020. Undoubtedly, the increase in the exchange rate took the lead in the increase in costs.

Total construction costs;

- While 30.34% was the increase in construction materials,

- 13.74% were labor costs.

The total surface area of the buildings, for which construction permits were granted in 2020, is 111 million m². While 64 million m² of building permits were given to residences, 26 million m² of non-residential buildings were given. The remaining license area has been realized for common use areas.

What Happened in the Housing Sector in 2021?

The effect of the worldwide pandemic in 2020 caused a large number of data to turn negative compared to previous years. In 2021, as a result of the increase in the measures against the effect of the pandemic, partial recovery was experienced in almost every sector. Although improvements have been seen in the real estate sector from time to time, serious cost increases were generally encountered in 2021 as well.

In 2021, approximately 1 million 491 thousand residences were sold throughout Turkey. According to this data, it is noteworthy that the sales figure slightly decreased compared to 2020. Housing sales in Turkey are mostly;

- Istanbul,

- Ankara,

- It happened in the cities of Izmir.

Based on commercial real estate market data; It is seen that the mortgaged house sales realized in 2021 decreased by 48.6% compared to 2020. Increases in housing loan interest rates were effective in the significant decrease in mortgaged house sales compared to the previous year. As the interest rates increased compared to 2020, the number of houses purchased in return for loans decreased in 2021.

In 2021, new house sales were 461.523 and second-hand house sales were 1,030,333. According to these data; Zero house sales in 2021 decreased by 1.7% compared to 2020.

Contrary to new housing, second-hand housing increased by 0.1% in 2021 compared to the previous year. This situation reveals that high interest rates directly affect the type of acquisition of the houses sold. Due to the high interest rates, individuals have turned to second-hand houses.

In 2021, a total of 58 thousand 576 residences were sold to foreign citizens. The provinces where house sales were made took place in the same way and in the same order as in 2020.

How Did Construction Costs Realize in 2021?

In 2021, it is seen that construction costs have increased even more due to the increasing exchange rate. It was determined that construction costs increased by 67.74% in 2021 compared to the previous year. Building construction cost rates were realized as 66% in 2021. Cost increases in building construction;

- 85.01% is from the increase in material costs,

- 24.04% was due to the increase in labor cost.

What Does the Turnover Index Say?

According to the commercial real estate market data, the turnover index in the industry, trade, construction and service sectors in 2021 was 82.4% on an annual basis. The turnover index experienced only in the construction sector was 46.4%. The elements, which are cleared from the criteria determined to be of a temporary nature, ensure that the turnover index obtained is seasonally and calendar-adjusted data.

The surface area of the buildings, for which construction permits were granted in 2021, increased by 24.1%. On the basis of surface area, 56.4% of the construction permit transactions were realized as residential areas. 75.2% of the area for which the building permit was given according to the intended use was for buildings with two or more flats.

Commercial Real Estate Market: Logistics Sector

The increasing demand of companies for qualified warehouses continued in 2021 as well. Although the demand for qualified warehouses has increased due to the pandemic, it has been observed that the supply is limited. Therefore, there has been a 16% increase in primary rents compared to 2020.

Companies tend to increase their demands for qualified warehouses in the following periods. For this reason, companies attach importance to having more qualified warehouse space in the logistics facilities they plan to rent. As a result of the increase in logistics costs around the world, it is seen that many important companies in Turkey are attempting to establish a logistics facility. Warehouse area rental transactions increased by 12% compared to 2020 and amounted to approximately 55 thousand m².

According to the commercial real estate market data, in the logistics sector, approximately 7 million m² of commercial logistics supply for sales and rental purposes was in question in 2021. In 2021, 232,553 m² of the existing areas were leased. The e-commerce sector took the first place in warehouse rental transactions in 2021. However, the first three sectors and their rates are as follows:

- E-commerce 34%,

- Retail 31%,

- Party logistics 29%.

Logistics leasing transactions in Turkey in 2021 were realized as 4.25 USD per m² on USD basis. This amount was 50 TL per m² in TL basis. There is a 43% increase in warehouse rental fees in primary rents from the previous year.

As a result of the increase in the need for special and qualified warehouses, an upward pressure is expected on logistics rental prices in the coming periods. Such a positive development of the logistics market in 2021 was largely due to the pandemic.

What Happened in the Office Market?

Immovable properties in Istanbul are among the ones that attract the most attention in class A office supply. According to the commercial real estate market data, the supply area in the Class A office market in Istanbul was 5.8 million m². Due to the fact that the office supply under construction in 2021 is approximately 1.6 million m², an increase in the existing office supply is possible in 2022 and 2023. Even considering the available data; Office supply is expected to be 7.5 million m² in 2023.

According to 2021 data, a total of 87,351 m² of office space has been rented this year. It took the lead in office rentals in Ataşehir in Istanbul and Levent in CBD. In 2021, primary rents increased by a total of 29.7% year-on-year.

Commercial Real Estate Market: What Happened in the Hotel Market?

The hotel market is a market that is directly affected by international tourist movements. Accommodation and travel restrictions due to the pandemic in Turkey directly affected the hotel market.

As a result of the gradual lifting of the bans, there was a revival in the hotel market. The hotel market in Turkey is more lively in summer. In addition, a more intense demand occurs in coastal areas.

According to the 2021 Year-End Turkish Commercial Real Estate Market Outlook Research Report, the number of foreigners visiting Turkey has increased in 2021 compared to 2020. In 2021, approximately 28 million tourists visited Turkey. Compared to 2020, the rate of visitors to Turkey in 2021 was 94%.

As the number of tourists coming to Turkey increased in 2021, there was an increase in tourism revenues. In fact, these revenues were twice the amount realized in 2020. An increase was observed in hotel occupancy rates in 2021 compared to 2020. In 2021, hotel occupancy rates were 52%. With the increase in hotel occupancy rates, hotel room accommodation fees have also increased compared to 2020.

In 2021, the Turkish commercial real estate market has shown serious developments compared to 2020. The data in 2021 is still behind the data before the pandemic. It can be predicted from the available data that there will be positive developments in the coming years.